- Metrobank Savings Account Requirements

- Metrobank Savings Account For Students

- Metro Savings Bank

- Metrobank Online Account

- Metrobank Savings Account Maintaining Balance

- Metrobank Savings Account Passbook

What makes blogging a rewarding side hustle (or full-time job, hopefully) is the opportunity to learn from you. It’s such a great way to start the year.

So the credit for this post goes to a reader who shared the information on how to open a Metrobank account in Canada on my post about opening a Philippine Bank account in Canada.

Kudos, kabayan. This must be the modern version of bayanihan.

Steps on How to Apply for Metrobank Savings Account Go to the nearest Metrobank Remittance Partner in your Country. Inform the bank officer that you’re going to open a savings account. Fill out the Account Opening Form and Deposit Slip for your initial deposit (P2,000 for ATM Savings).

- Dormant Account: If you do not do any transactions through your savings account for more than 24 months, the account will be classified as 'Dormant'. How do I reactivate my deactivated debit card? When you call to report your card lost/stolen, the bank will immediately suspend the card.

- Open a Savings Account in Metrobank now! This is the most updated way to open a bank account in 2019.Have any questions? Feel free to post it on the comments.

- Metrobank Interest RatesThe 'Metropolitan Bank and Trust Company' or Metrobank is a major universal bank in the Philippines. It is listed on the Philippine Stock Exchange with the symbol MBT and is a member of Philippines Deposit Insurance Corporation.Metrobank was established in 1962 and provides b.

- Your eligible deposits with Metro Bank PLC are protected up to a total of £85,000 by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme. Any deposits you hold above the limit are unlikely to be covered. For further information visit www.fscs.org.uk. Registered in England and Wales.

Steps on How to Open a Metrobank Account in Canada

According to a tip from a reader, Filipinos can open a savings or passbook account in Canada. No chequing account.

If you live somewhere else, I’m sure the steps below are somewhat similar where you’ll open a Metrobank account.

Step 1: Locate the foreign Metrobank branches in North America. (Refer to the list later.)

Step 2: Gather and submit all the requirements. Call the Metrobank branch to make sure you have everything you need before personally submitting the requirements.

- Passport (Canadian or Philippine)

- Government issued ID (e.g. Driver’s license, health card, etc.)

- Paycheque or a pay stub in the last three months

- Dual citizenship certificate (if applicable)

- Birth certificate

- Fee (our kababayan can’t remember how much but said that it isn’t much)

Bring the original and photocopy of the requirements. The Metrobank office location of your choice in the Philippines will receive the complete requirements.

Step 3: Wait for the application to be completed. The processing time is three months.

Lucky Tiger Casino $55 No Deposit. Bonus Code WILD55. Read Review Play Casino. Casino name: Lucky Tiger Casino Amount: $55 No Deposit Valid for: New Bonus type: No Deposit Bonus Expires on: 50xB. More bonuses for Lucky Tiger Casino. Amount: $35 No Deposit Play through: 50xB Max Cashout: $50 Valid for: All players. Bonus Code 35CASHCHIP. Lucky tiger no deposit codes. Lucky Tiger Casino is offering an EXCLUSIVE $55 No Deposit Bonus for new players, visit us for the bonus code! This 'no deposit bonus' can be claimed by new registered players only at Luck Casino. This is a 'free chip', no deposit required: just claim the bonus code ' TOPSECRET40 ' in the casino cashier. The bonus holds a minimum WR of 50x (b) that must be completed prior to making any withdrawal. Lucky Tiger Casino Bonus Codes 2021 Find the Best Lucky Tiger Casino Coupons on Chipy.com! Exclusive No Deposit Bonuses, Free Spins, and more!

Step 4: Claim your Metrobank passbook or ATM card. The latter is more convenient for OFWs because you can remit to the account and check your Metrobank account online.

Now that you’re aware with the steps, let’s go back to step 1 and find out the overseas branches.

Metrobank Overseas Offices

The foreign Metrobank branches are located in America, Asia, and Europe. But for this post I’ll only include the offices in Canada.

Vancouver Office

Address: 4292 Fraser Street Vancouver, BC V5V 4G2

Tel: 1 (604) 874 – 3373

Fax: 1 (604) 874-3374

Email: vancouver@metroremittance.ca

Business Days/Hours:

Mondays to Saturdays – 10:00 am to 5:30 pm

Sundays – 10:00 am to 4:00 pm

Metrobank Savings Account Requirements

Toronto Office

Address: 569 St. Clair Ave. West Toronto, ON M6C 1A3

Tel: 1 (416) 532 – 9779 / 1 (416) 532 – 3223

Fax: 1 (416) 534 – 4040

Email: toronto@metroremittance.ca

Business Days/Hours:

Mondays to Saturdays – 10:00 am to 7:00 pm

Sundays 10:00 am to 5:00 pm

That’s not much list of offices in Canada. For Filipinos living in this areas, take advantage of the opportunity to open a Philippine bank account if you don’t have any yet.

There’s No Metrobank Office Where I Live

I know how frustrating it is. But you still have an alternative. You could check if opening a PNB account is possible in different branches.

- Ontario (Mississauga,

Sherbourne, Scarborough, and Wilson) - British Columbia (Vancouver and Surrey)

- Manitoba (Winnipeg)

Metrobank Savings Account For Students

Tip: I was able to open a PNB account in Calgary, Alberta. Make a phone call and ask if there are agents in other areas that are not listed in the online list.

Metro Savings Bank

That’s all the trick I can share for this post. I can’t wait to learn and share more tips from our fellow kababayan.

If you are able to open a Metrobank account or other Philippine bank account in Canada or somewhere else, let us know in the comment.

MORE POSTS:

Metrobank Online Account

Having your own personal savings account can prove to be useful in more ways than one. For people on the go, the convenience of not having to carry cash with them will prove to be very essential when their lifestyle involves a lot of travelling. For people who support their family from overseas, sending remittances directly to their account would be priority. And even for the average working Filipino, the value of saving money for their future as well as getting insurance are some of the common reasons why people open a savings account with Metrobank.

Considered as one of the biggest and longest-running commercial banks in the country, Metrobank has built its name from its commitment to business success and community involvement. It is for this reason why many people opted to sign up with Metrobank for their savings account. If you, too, are interested in opening an account with Metrobank, here’s how:

Applying for a Metrobank Savings Account

Signing up for a Metrobank savings account entitles account holders to the following perks and benefits:

- Low initial deposit and required maintaining balance of Php 2,000 for a regular savings account.

- The required average daily balance to earn interest is Php 10,000.

- High interest rate of 0.125% per annum.

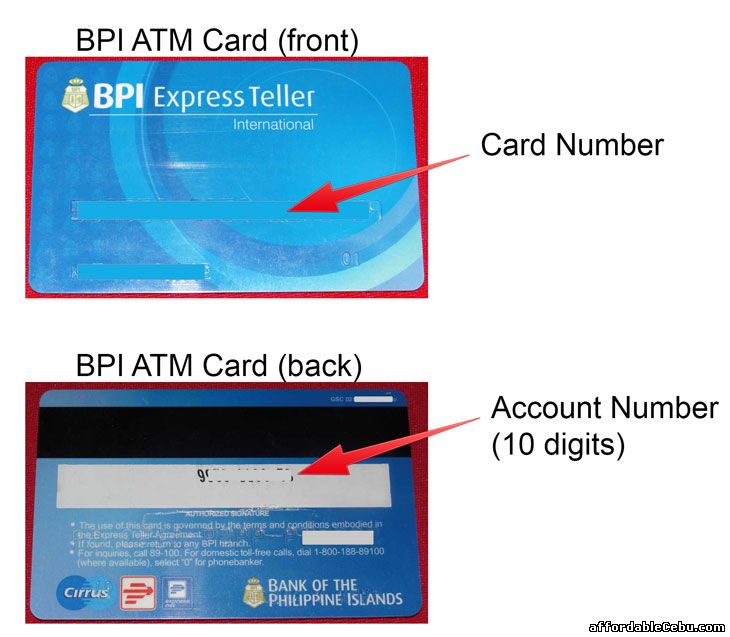

- Documentation through either an ATM or debit card.

- Go cashless on your purchases and maximize rewards from your ATM or debit card for your shopping transactions through various point-of-sale (POS) terminals available in a wide array of commercial establishments nationwide.

- Funds of up to Php 500,000 are automatically covered and insured by the Philippine Deposit Insurance Corporation (PDIC).

Requirements:

Metrobank Savings Account Maintaining Balance

- Any two (2) of the following government-issued valid IDs with photograph:

- Postal ID

- Barangay Clearance

- NBI / Police Clearance

- Passport

- Driver’s License

- Voter’s ID

- PRC License

- Senior Citizen’s Card

- SSS / GSIS I Card

- And others

- Two (2) copies of your 1 x 1 or 2 x 2 recent coloured photograph

- Proof of billing (e.g. electricity, water, landline/internet, and credit card bills, among others) to verify the applicant’s place of residence

- [NEW] TIN and/or SSS number

- An initial deposit of Php 2,000 or more to open a regular savings account.

Procedures:

- Go to the nearest Metrobank branch in your place and bring all the above-listed requirements with you. Ask assistance from the bank officer stationed at the New Accounts section for opening a Metrobank regular savings account.

- Completely fill out the set of application forms that you will be provided with. Double-check all the details that you have specified in the forms to make sure that everything is accurate and valid.

- After you have completed the forms and sumittedthe requirements, the bank officer will verify and review the details of your application and paper documents to see if everything is in order.

- Settle the initial deposit fee of Php 2,000 minimum. Be sure to keep the deposit slip that you will be issued upon payment as you will need to present this together with one (1) valid ID for the collection of your ATM or debit card as well as your other bank documents.

Metrobank Savings Account Passbook

Note: Issuance and release of ATM and debit cards usually takes between 5 to 7 days before. Can bingo halls open. You may request for the bank officer’s contact info so that you would know through him/her whether you card is ready for pick up or not.